2021-05-27 10:11:13 来源:

我们可以从硅谷以外、新兴生态系统和市场的领先企业家那里学到很多东西。在那里,他们长期面临资本短缺,缺乏关键资源以及定期的宏观经济冲击。58003

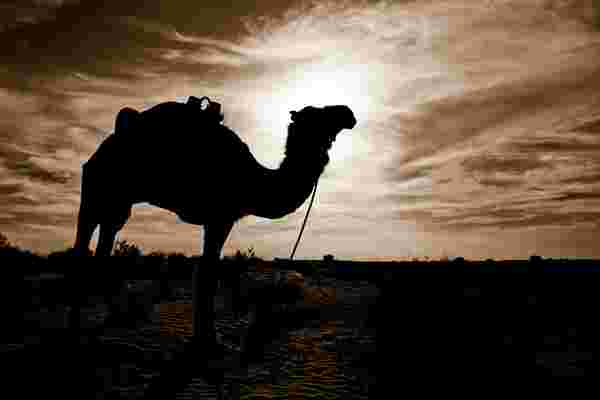

Camel startups survive because they prepare for the worst, and even companies in more secure markets have a lot they can learn from Camels as they prepare for the unexpected.

As Monica Brand Engel, the co-founder of Quona Capital, a leading emerging market investment firm, once quipped, “breakeven is the new black.” This not only is a smart strategy in places with scarce venture capital, but also it can mean the difference between survival and failure in the event of a severe shock. Camel startups control costs and charge fair value for their products so that their growth is built on a fundamentally sound footing. These two elements keep Camel startups within a stone’s throw of sustainability and make for responsible growth. Because growth is controlled and the bottom of the cost curve is not nearly as deep for Camels as for growth-at-all-cost unicorns, they can elect when to raise capital. Some companies like Mailchimp and Basecamp chose not to take any venture capital at all. While this is not an argument against venture capital (full disclosure; I am a venture capitalist), Camel startups realize they can choose whether, from whom, and on what terms to raise venture capital. The smartest Camel startups raise capital with a particular growth strategy in mind and raise only the amount they need.

Camel startups anticipate various crisis scenarios, communicate their plan to investors, and take action when required. Look at Zoona, a mobile money company in Zambia. Keith Davies, a co-founder, invested in a detailed financial model that forecasts many economic drivers based on the vibrancy of Zoona’s financial service booths, as well as the resulting cash needs of the business under multiple scenarios. Looking back at an episode in 2016when the currency crisis hit and the Zambian kwacha devalued more than 70%, as Davies explains it, “We were able to understand with confidence and show our investors and partners a range of potential outcomes, and how our business would fare in each.” When thecurrency crisis hit, Zoona acted fast. It assessed the impact of the massive devaluation on the business and then called investors and made a plan of action—including rightsizing the company, slowing investment, and modulating various costs. As a stopgap, the company received a small capital injection and actively tracked the evolving situation.

In case one part of the business takes a severe hit, Camel startups have other strategic options they can turn to. Often, this means persifying from a product, geography or client perspective. 58003 Camel startups often take a more financially sound strategy—reflective of the complexities of their ecosystems—by building persification into their product mix. VisionSpring, a global social enterprise that offers eyeglasses to the poor, has three business lines: sales to wholesalers, sales through intermediaries, and direct sales (in partnership with local nonprofits for distribution). It is active in six markets. This effectively means that there are eighteen businesses, each at a different level of maturity and scale. The more mature ones support the others, and if one suffers, the others remain.

\Related:Mark Cuban's 12 Rules forStartups

Yet the portfolio approach can go too far. One of the reasons Silicon Valley advises against this strategy for startups is that building fast-growing companies is extremely difficult and requires a massive amount of effort and dedication. 58003 Therefore, the lesson should not be about building persification for its own sake or in a haphazard manner. Rather, it is about building a portfolio strategically, and when necessary.

Naturally, there are no “secrets” in the business of creating successful startups, and chance plays a factor in everything. However, Camel startups plan for uncertainty and in doing so, increase the likelihood they will survive in the long term.

免责声明:本网站所有信息仅供参考,不做交易和服务的根据,如自行使用本网资料发生偏差,本站概不负责,亦不负任何法律责任。如有侵权行为,请第一时间联系我们修改或删除,多谢。

© 2018 今日中国财经 版权所有